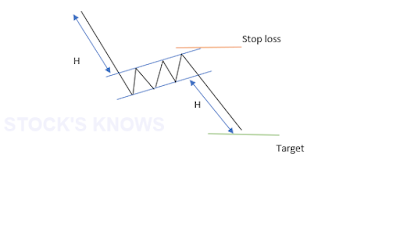

Hey friends, welcome to Stock's Knows. Today we will understand about a charting tool which is commonly used by technicians to identify perfect entry and exit points in any trade. Finding perfect entry and exit point is as much important as finding a perfect stock to enter.

Because if you find perfect stock but you entered at the wrong point, it will cost you money.

Hence we need to find perfect entry and exit points to enter into any trade.

Because if you find perfect stock but you entered at the wrong point, it will cost you money.

Hence we need to find perfect entry and exit points to enter into any trade.