Hey friends, welcome to Stock’s Knows. This is 4th part of chart patterns’ article. Today we will understand my favorite two chart patterns: Flags and Pennants. They are my favorite because they provide high reward as compared to risk, sometimes we can find 10 times reward as compared to risk. So, they are most rewarding chart patterns.

Flags and pennants both are continuation patterns and both form in the middle of the trends. They consist of poles and flags or triangles. Poles are previous directional moves in the direction of their trends. In the uptrend, after some upward moves, there was some consolidation period. Consolidation period looks like triangles or parallel channel.

The full pattern looks like flag or triangle connected with poles. As they are continuation patterns, they are both bullish and bearish type.

|

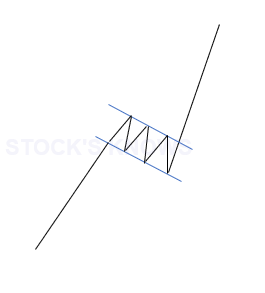

| Flag |

|

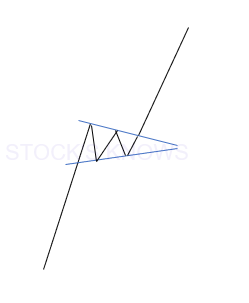

| Pennant |

The full pattern looks like flag or triangle connected with poles. As they are continuation patterns, they are both bullish and bearish type.

1)Bullish flag:

Bullish flag pattern forms in the middle of the uptrend. Hence it is a bullish continuation pattern.

|

| Bullish Flag |

How to trade?

Trade when breakout happens. One can go long when breakout of bull flag pattern happens.

Where to put stop loss?

In a bull flag pattern, stop loss must be below flag level or below the previous low.

For target calculation, one needs to measure the length of the pole from starting of uptrend to flag and need to project it above the flag.

2)Bear Flag:

Bearish flag pattern forms in the middle of the downtrend. Hence it is a bearish continuation pattern.

To trade bear flag pattern, one needs to go short when breakout of flag happens.

Where to put stop loss?

Perfect stop loss level is above flag or above the previous high.

How to calculate Target?

|

| Bearish Flag |

For target, one needs to measure the length of the pole from starting point of downward movement to the flag. And need to project it below the flag.

3)Bullish pennant:

Bullish pennant also forms in the middle of the uptrend. It is also bullish continuation pattern.

One can go long when breakout of pennant pattern happens.

Where to put stop loss?

Perfect stop loss would be below the pennant or below the previous low.

For target, one needs to measure pole length from starting uptrend to the pennant and need to project it to above pennant from breakout level.

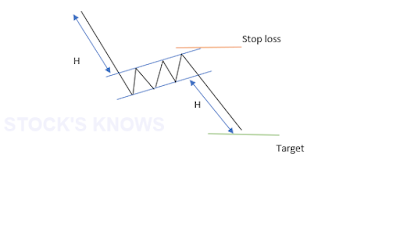

4)Bearish Pennant:

Bearish pennant is the bearish continuation pattern. It also forms in the middle of the downtrend.

To trade bearish pennant pattern, one can go short when breakout of pennant happens.

Where to put stop loss?

Perfect stop loss would be above previous high or above pennant.

How to calculate Target?

|

| Bearish Pennant |

To calculate target, one needs to measure the pole length from starting point of downtrend to the pennant and need to project it to below the pennant.

Note: You can use the entire length of the pole in all above cases to project 2nd target but in that case, you need to use trailing stop loss or need to book partial profit around the 1st target.

Note: You can use the entire length of the pole in all above cases to project 2nd target but in that case, you need to use trailing stop loss or need to book partial profit around the 1st target.

Those were two most rewarding continuation patterns. Remember that they look like triangles but they are smaller than triangles. If you find helpful above information then please Share our article and Subscribe to the newsletter of our blog.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.